Market Wrap - 27 October , 2025

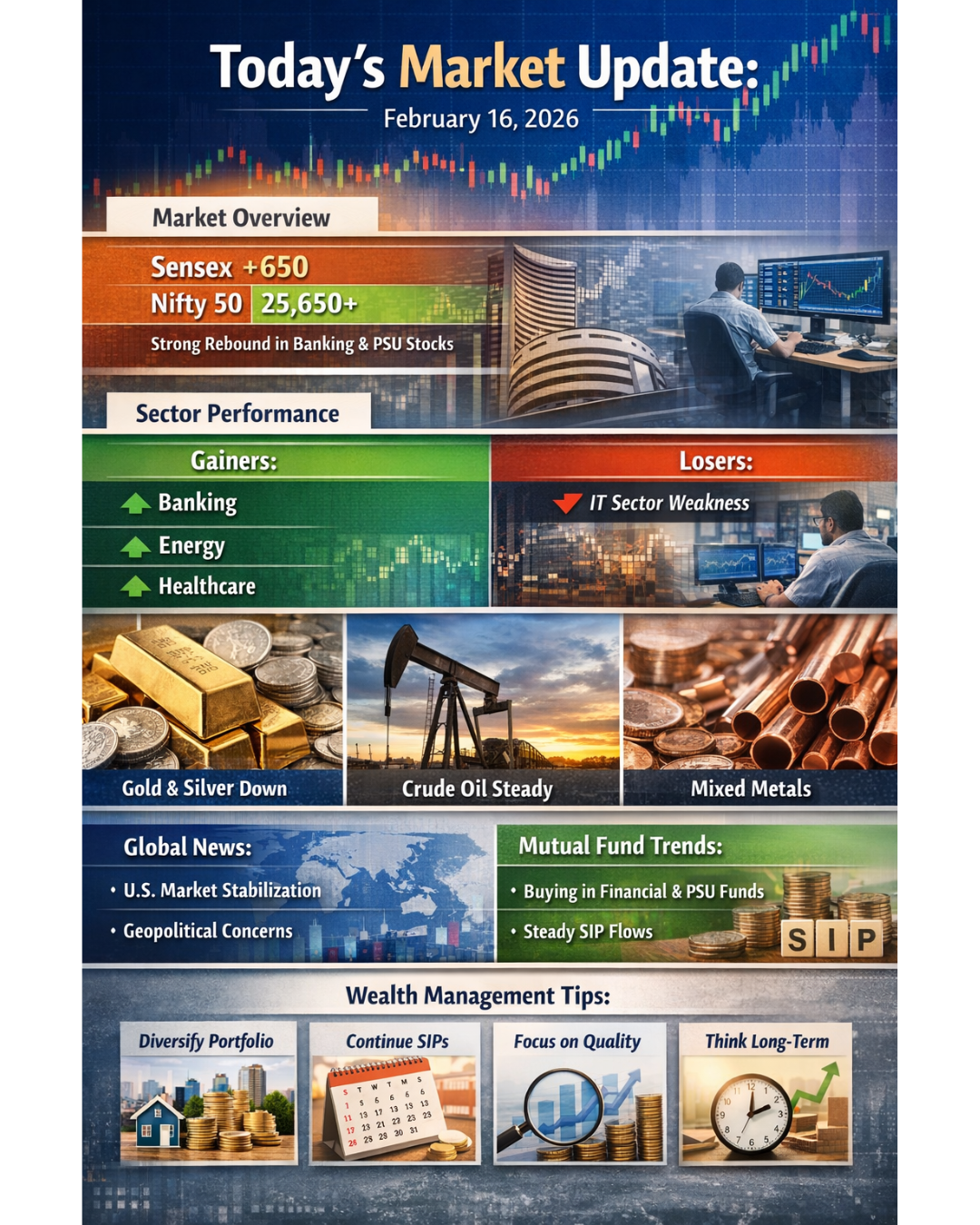

1. Indian Equity Markets at a Glance

The Indian markets started the week on a strong note, extending Friday’s recovery amid positive global cues and buying interest across sectors.

- BSE Sensex closed at 84,778.84, gaining 566.96 points (0.67%).

- Nifty 50 ended at 25,966.05, up by 170.9 points (0.66%).

- Nifty Futures (October) traded at a premium of around 70 points, indicating bullish sentiment ahead.

The broader markets mirrored the upbeat trend:

- Midcap index rose by 0.93%

- Smallcap index gained 0.82%

- Nifty Bank index also moved higher, driven by strong buying in private and PSU banks.

Investor View:

The positive momentum suggests renewed optimism among traders and investors, supported by global recovery trends and strong quarterly results from domestic companies. For investors, the focus should remain on quality large-cap stocks and diversified mutual funds.

2. Top News & Business Highlights

Government Reforms:

India’s government and regulators have initiated new financial sector reforms to attract global investors after approximately $17 billion worth of foreign outflows this year. These changes aim to simplify corporate borrowing norms and strengthen the domestic capital markets.

Mutual Fund Industry Milestone:

The mutual fund industry has touched a record ₹75.61 lakh crore in AUM (Assets Under Management) as of September 2025. Mumbai continues to be the largest contributor, with over ₹20.5 lakh crore, accounting for nearly 28% of the country’s total mutual fund investments.

Fund Managers’ Outlook:

Leading fund houses have projected 8–12% annual returns for equity mutual funds in the current cycle. The key focus areas remain technology, hybrid funds, and diversification into new-age investment products.

Key Takeaway for Investors:

India’s strong domestic participation, coupled with ongoing reforms, indicates a resilient financial ecosystem. However, investors must align expectations realistically and focus on long-term wealth creation rather than short-term speculation.

3. Mutual Fund & Investment Insights

Top-Performing Funds:

Around 12 equity mutual fund schemes have reported over 15% CAGR since inception, proving the power of long-term investing. These include a mix of large-cap, mid-cap, flexi-cap, and ELSS (tax-saving) categories.

Debt Fund Trends:

Banking & PSU Debt Funds are emerging as preferred choices for conservative investors. These funds invest primarily in securities issued by banks, public sector undertakings, and government financial institutions, offering stable returns with reduced credit risk.

Commodity Investments:

Interest in Silver ETF Fund-of-Fund schemes has risen again, as fund houses reopened subscriptions after temporary pauses earlier this month. This shows growing investor interest in alternative and commodity-based investments.

Investment Advice:

Maintain diversified portfolios—mix equity for growth, debt for stability, and alternatives for hedging.

Focus on long-term SIPs instead of lump-sum entries during market highs.

Use market dips to average out investments and enhance long-term returns.

4. What Should Investors Do Now?

- Stay Invested: Avoid panic-selling or profit-booking prematurely; markets are showing resilience.

- Focus on Fundamentals: Choose strong companies or well-managed funds with consistent performance.

- Use SIPs Wisely: Continue or increase SIP amounts during corrections to benefit from cost averaging.

- Diversify Across Categories: Include both equity and debt instruments to balance risk and reward.

- Be Realistic: Expect 8–12% average annual returns over the next cycle instead of unrealistic short-term gains.

- Educate & Review: Regularly review your portfolio with financial advisors and stay updated on reforms.

5. Blissmoney Insight

Today’s market strength, coupled with structural financial reforms and mutual fund expansion, paints a positive long-term picture for Indian investors.

At Blissmoney Fintech Pvt. Ltd., we believe this is the time to:

- Invest strategically, not emotionally.

- Diversify smartly across sectors and fund types.

- Stay informed and make every rupee count towards your future wealth.

Your financial growth journey doesn’t stop here — it starts here.