Market Wrap: Last Trading Day of 2025 – Year-End Closing Summary

Indian Equity Markets – Closing Overview

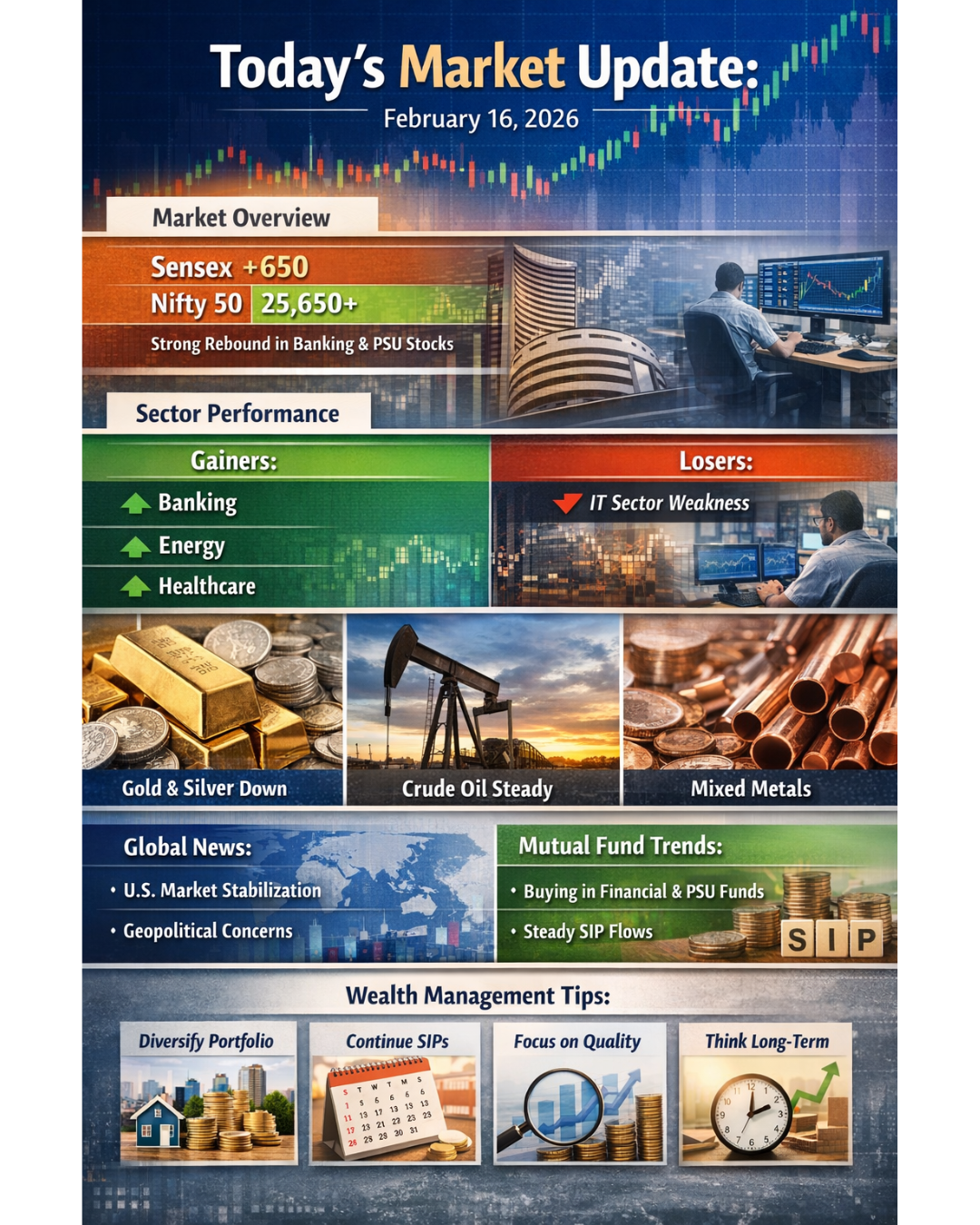

Indian equity markets concluded the final trading session of 2025 on a stable to positive note, supported by selective buying and year-end portfolio adjustments. Trading volumes remained relatively muted as institutional investors closed their books for the calendar year.

- Nifty 50 closed around the 26,000 mark

- BSE Sensex ended near the 85,000 zone

Despite phases of volatility during the year, Indian benchmark indices closed 2025 with moderate positive returns, supported primarily by strong domestic participation, steady earnings growth, and resilient macro fundamentals.

Key Market Numbers (Year-End Snapshot)

Nifty 50: ~25,900 – 26,100

Sensex: ~84,700 – 85,300

Broader Markets: Mid-cap and small-cap indices witnessed selective profit booking toward year-end

Volatility: India VIX cooled, indicating reduced near-term uncertainty

Currency: The Indian rupee remained under pressure during the year, influencing export-oriented sectors

Market News & Sector Highlights

- Financials: Continued to provide stability to the indices, backed by credit growth and balance sheet strength

- Metals & Industrials: Saw renewed interest driven by global cues and infrastructure-related optimism

- IT & Export-Oriented Stocks: Found support due to currency movement, though global demand remained mixed

- Consumption & FMCG: Displayed steady but selective performance amid inflation sensitivity

Year-end trading was influenced by global market holidays, low participation, and portfolio rebalancing activity.

Mutual Fund Updates

- Equity mutual funds ended 2025 with healthy long-term returns, particularly in diversified large-cap and flexi-cap categories

- SIP inflows remained consistent throughout the year, reflecting growing retail investor discipline

- Investors are advised to evaluate mutual fund performance based on risk-adjusted returns and goal alignment, rather than short-term rankings

Wealth Management Perspective

- The year 2025 reinforced the importance of asset allocation, diversification, and disciplined investing

- Investors who maintained SIPs and avoided emotional decisions were better positioned during volatile phases

- Year-end portfolio reviews and rebalancing are recommended to align investments with long-term financial goals

Outlook for 2026 – Long-Term Investor View

The outlook for Indian equities entering 2026 remains constructive with measured optimism.

Key factors to monitor:

- Corporate earnings growth trajectory

- Interest rate and inflation trends

- Domestic consumption and capex cycle

- Global economic and geopolitical developments

For long-term investors, systematic investing, diversification across asset classes, and patience remain the most effective strategies for sustainable wealth creation.