Market Wrap-Up 12 January 2026: Sensex & Nifty Rebound, Gold and Silver Hit Record Highs, FIIs Sell

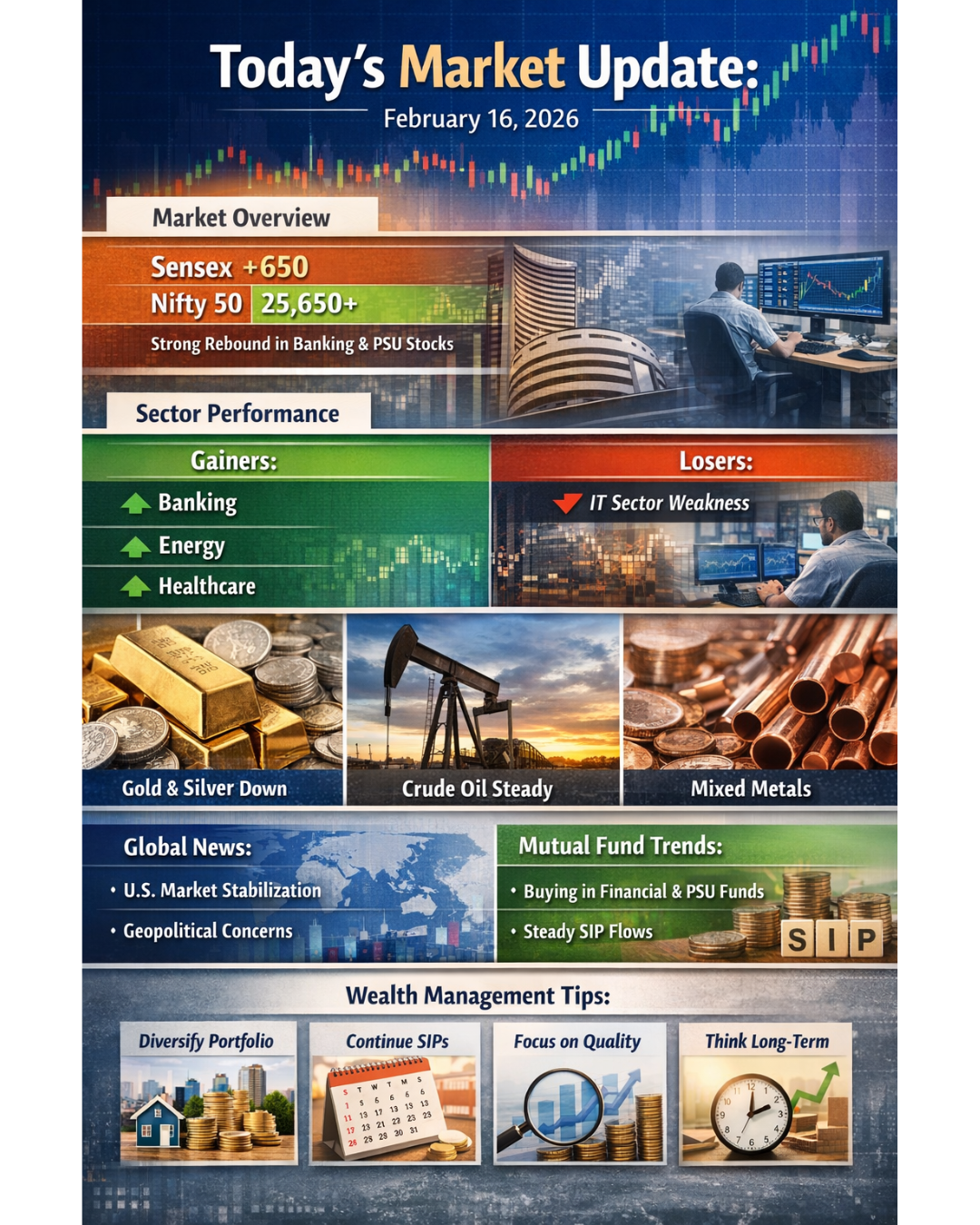

Indian Equity Markets

Indian benchmark indices ended the session higher, recovering from early losses amid continued global volatility and strong domestic institutional support.

- BSE Sensex: Closed at 83,878, up 302 points

- Nifty 50: Closed at 25,790, up 107 points

Markets opened weak due to foreign selling pressure but witnessed a sharp rebound in the second half as domestic investors stepped in. Buying interest was seen in select banking, metal, and energy stocks, while mid-cap and small-cap stocks underperformed.

Sector Performance:

- Metals: Strong gains

- PSU Banks & Energy: Moderate gains

- FMCG & Financials: Flat to positive

- Pharma, Realty, Capital Goods: Weak

- Mid & Small Caps: Under pressure

Commodities Market

Precious metals rallied sharply, driven by global uncertainty and safe-haven demand.

- Gold (MCX): Rose over 2%, trading near ₹1,41,250 per 10 grams (record levels)

- Silver (MCX): Jumped 4–5%, trading around ₹2.62–2.65 lakh per kg (record high)

- Crude Oil: Brent Crude: Traded around USD 63–63.5 per barrel. Oil prices remained range-bound, supported by geopolitical risks but capped by oversupply concerns and weak global demand outlook.

Global Markets

- US Markets: Ended marginally higher with continued volatility

- Asian Markets: Mostly positive, tracking Wall Street cues

- European Markets: Mixed, cautious amid political and economic uncertainty

- Global markets remained sensitive to political developments in the US and ongoing geopolitical tensions in the Middle East.

Trump-Related Developments & Global Tensions

Markets remained on edge due to renewed political uncertainty in the United States.

Key developments:

- Former US President Donald Trump intensified criticism of the US Federal Reserve, raising concerns about policy independence.

- Reports of potential legal and political actions against senior Fed leadership triggered risk-off sentiment.

- These developments weakened the US dollar and boosted demand for safe-haven assets like gold and silver.

- Additional global tension emerged from unrest in parts of the Middle East and concerns around global trade and energy supply chains.

- Overall, Trump-related political pressure added to volatility across global equity, currency, and commodity markets.

FII & DII Activity (India)

- FII (Foreign Institutional Investors): Net sell of approximately ₹3,638 crore

- DII (Domestic Institutional Investors): Net buy of approximately ₹5,839 crore

Domestic institutions continued to absorb foreign selling, helping Indian markets close in positive territory despite global headwinds.

Mutual Funds & Wealth Management View

Continued SIP inflows and domestic participation supported market stability.

Wealth managers are advising a balanced and diversified approach, with increased allocation towards:

- Large-cap equities

- Defensive sectors

- Gold and other hedging assets

Volatility is expected to persist in the short term, but long-term fundamentals remain intact for disciplined investors.

Market Outcome & Outlook

- Markets recovered despite global uncertainty, supported by strong domestic buying.

- Precious metals outperformed, reflecting heightened risk aversion.

- Oil remained volatile, balancing geopolitical risks and oversupply fears.

- FII selling continues, but DII support remains a key stabilizing factor.

- Near-term volatility likely, driven by US political developments, global economic data, and geopolitical tensions.

Overall Outcome:

The market sentiment remains cautiously optimistic with strong domestic resilience, but investors should stay selective and focus on long-term asset allocation rather than short-term noise.