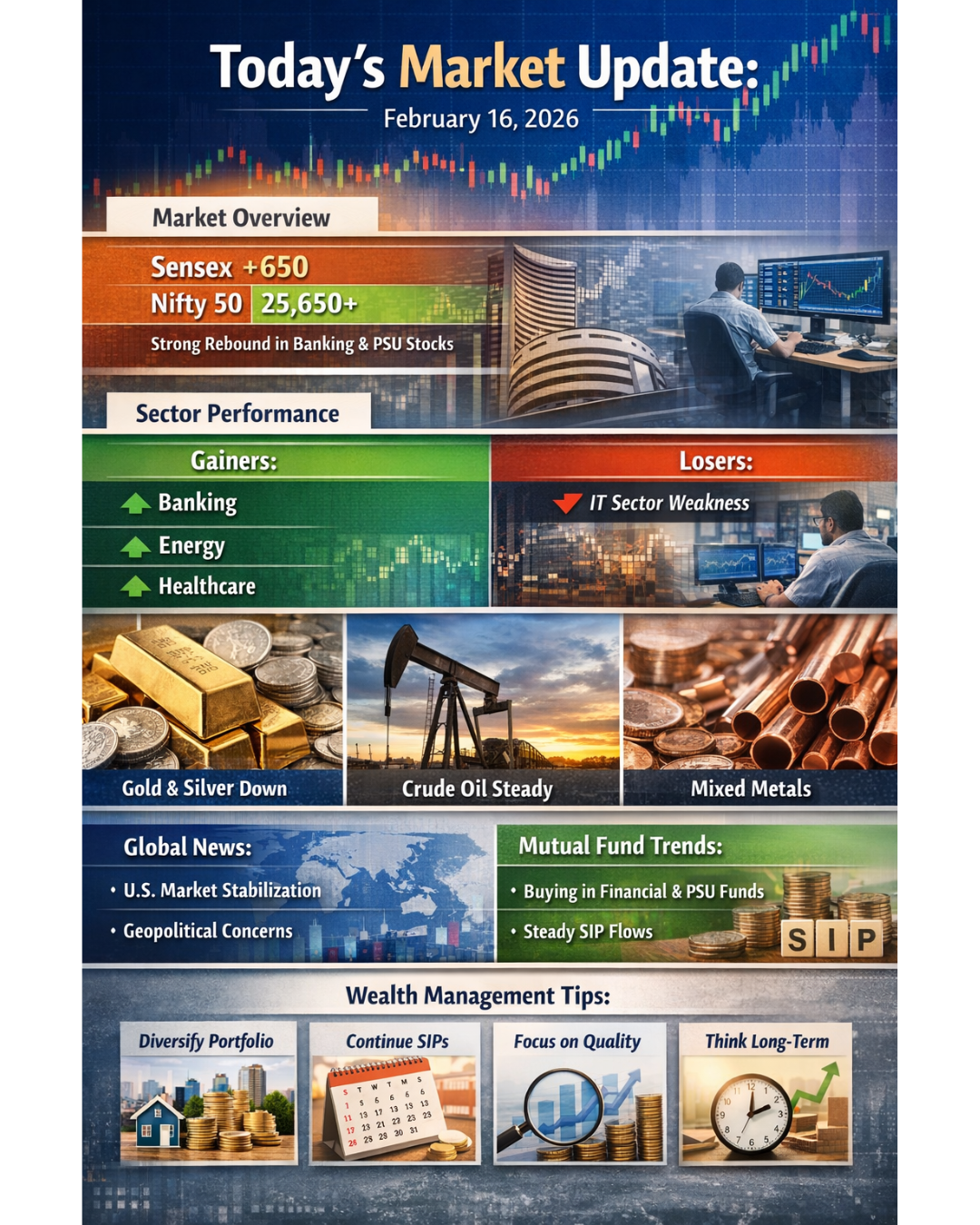

Market Wrap-Up: Indian Indices Slide Amid Trade & Financial Sector Pressure

Market Close Snapshot

- Sensex settled at 83,409.69, down 287.6 points (�0.34%)

- Nifty 50 closed at 25,453.40, down 88.4 points (�0.35%)

Mid-Cap and Small-Cap indices also declined:

- Mid-Cap down ~0.18%

- Small-Cap down ~0.20%

Key Market Drivers

- Trade Tensions: Investor sentiment dipped as the potential U.S.�India trade deal deadline looms (July 9), pressuring financials.

- Financial Stocks Under Pressure: Heavyweights like HDFC Bank, Bajaj Finserv, IndusInd Bank, SBI Card, and Bank of Baroda dragged the indices lower.

- Mid- & Small-Caps Tumble: The Nifty MidCap100 fell ~0.14%, while SmallCap100 dropped ~0.41%.

Sector Highlights

- IT Stocks Resilience: The IT index climbed ~1.4%, driven by gains in Infosys and other tech names, buoyed by strong U.S. demand.

- Auto & Metal Show Strength: Tata Steel, JSW Steel, and automotive names saw gains; steel surged ~2% on global demand rebound.

- Power & Pharma Divergence:

- NTPC rose ~0.3%, outperforming the broader market.

- Dr. Reddy�s fell ~0.4%, underperforming pharma peers like Lupin and Wockhardt.

IPO Watch

HDB Financial�s Strong Debut:

HDB Financial Services debuted at ?835 � 12.8% above its IPO price � marking it the year�s largest listing and the eighth-largest NBFC by market cap.

Technical Outlook & Trading Insights

- Nifty 50 Levels: Immediate support ? 25,450; resistance ~25,670.

- Advance�Decline Ratio: Broader market breadth remained weak � 1,716 gainers vs. 2,125 losers.

- Volatility Eased: India VIX edged lower to ~12.44, indicating reduced intraday volatility.

What to Watch Next

- U.S.�India Trade Deadline (July 9): Could significantly influence financial and export-sensitive sectors.

- Earnings Releases: Tech results from Infosys and TCS may shape near-term market direction.

- Global Cues: Watch U.S. Fed signals, crude oil prices, and currency trends; rupee closed ~?85.7/$, slightly weaker.

Summary for Investors

- Risk-off sentiment dominates: Cautious stance ahead of trade clarity.

- Rotation trend: Tech and cyclical sectors outperformed financials and realty.

- Strategic approach: Use dips to enter quality IT, metal, or power names; avoid weak financials until tariff clarity emerges.