Trump’s Global Trade and Energy Strategy: Venezuela, Russia, and the Tariff Impact on Markets

Over the past few months, global markets have been closely watching a sharp shift in U.S. foreign and trade policy under President Donald Trump. What appears on the surface as geopolitical action is, in reality, a deeply interconnected strategy involving energy control, tariffs, and economic pressure, with far-reaching consequences for global trade and financial markets.

Two major developments stand out:

- U.S. intervention and strategic involvement in Venezuela

- A new draft proposal threatening up to 500 percent tariffs on countries buying Russian oil and gas

- Together, these moves signal a more aggressive use of economic power as a geopolitical weapon.

What Is Happening in Venezuela?

Venezuela holds the largest proven oil reserves in the world, yet years of sanctions, mismanagement, and political instability have crippled its economy. The United States has long opposed the Maduro regime, citing corruption, human rights violations, and links to organized crime.

Under President Trump, U.S. actions in Venezuela have intensified, with the administration openly stating its intent to restructure Venezuela’s oil exports, bring Venezuelan oil back into Western-aligned markets, and reduce the influence of China, Russia, and Iran in Latin America.

From a strategic standpoint, Venezuela is not just a political issue. It is an energy and supply-chain issue.

Why Venezuela Matters

- It can significantly influence global oil supply

- It plays a role in U.S. energy security strategy

- It impacts oil prices, inflation, and emerging-market stability

- Any shift in Venezuela’s oil flow has a direct ripple effect on global energy markets.

Trump’s Broader Energy and Trade Strategy

Venezuela is only one part of a much larger picture.

President Trump has consistently used tariffs, sanctions, and trade pressure as tools to influence global behavior. His policy approach focuses on forcing supply-chain realignment, limiting the influence of rival nations, and protecting U.S. economic and strategic interests.

This strategy has now expanded sharply to include Russia and countries that continue to trade with Russia’s energy sector.

The New Draft Proposal: 500 Percent Tariffs on Buyers of Russian Energy

A major new draft bill supported by President Trump proposes extreme secondary tariffs on countries that continue to buy Russian oil, natural gas, and related energy products.

Key Points of the Draft

- The U.S. could impose tariffs of up to 500 percent on imports from any country purchasing Russian energy.

- These tariffs would apply not to Russia directly, but to third-party countries trading with Russia.

- The policy targets major energy buyers such as India, China, and other emerging economies.

- This represents one of the most aggressive trade measures proposed in recent decades.

Why Is the U.S. Considering Such Extreme Tariffs?

The objectives behind this draft are clear:

- To cut Russia’s energy revenues, which are a major source of funding for its economy and military operations.

- To force countries to choose between access to discounted Russian energy and access to the U.S. consumer and financial markets.

- To reshape global energy trade routes and reduce dependence on Russia.

- This approach turns trade policy into a powerful geopolitical enforcement tool.

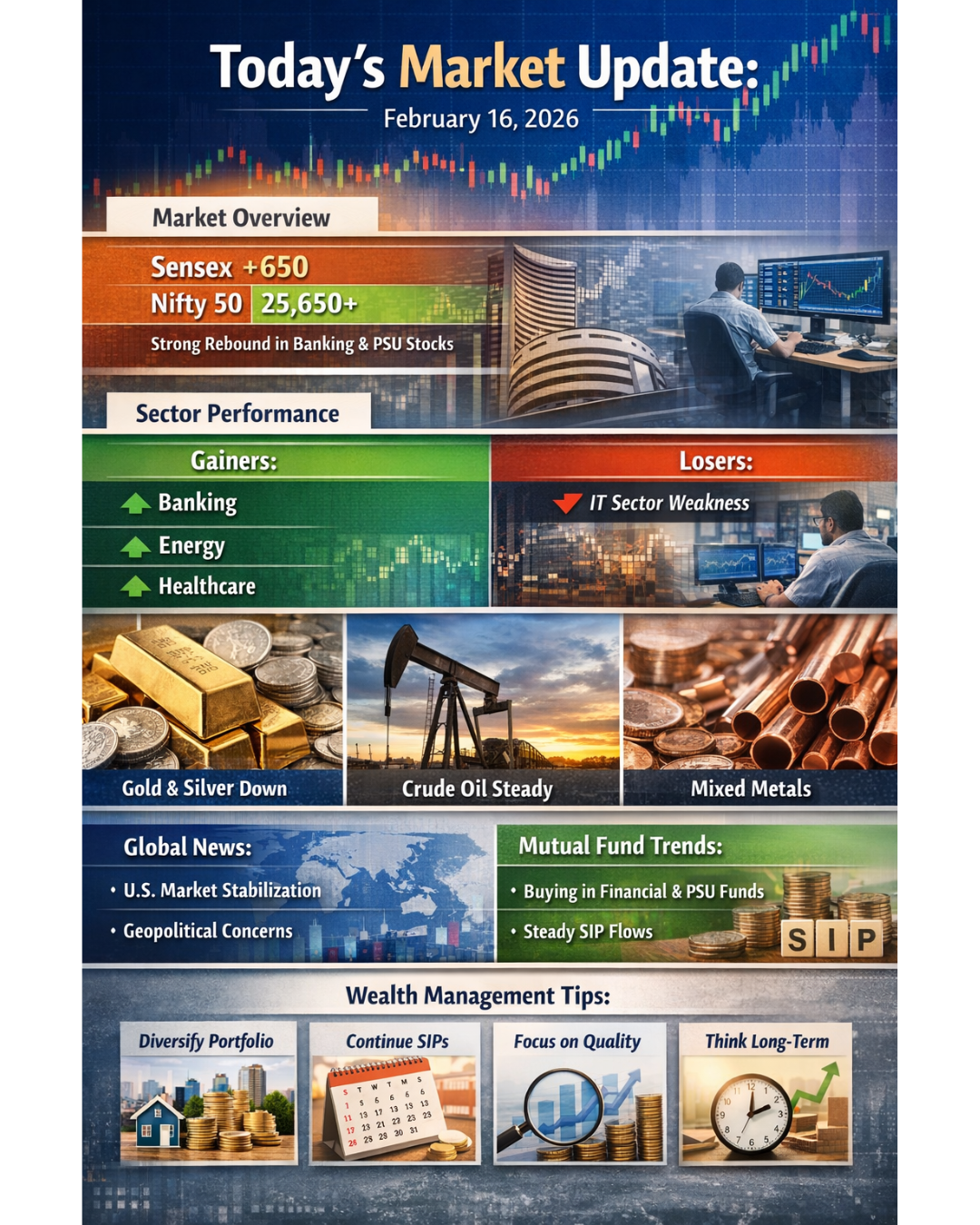

Impact on Global Markets

Oil and Energy Markets

- Increased short-term volatility in crude oil prices

- Buyers may shift to alternative suppliers, tightening supply elsewhere

- Persistent uncertainty could keep energy prices unstable

Equity Markets

- Energy companies may benefit from supply disruptions and higher prices

- Emerging-market equities could face pressure due to trade uncertainty

- Export-oriented sectors may experience valuation stress

Inflation and Consumer Costs

- Extremely high tariffs raise import costs significantly

- Higher costs are often passed on to consumers

- Inflation risks increase, particularly in tariff-affected economies

Global Trade and Supply Chains

- Companies may be forced to redesign supply chains

- Trade routes could shift away from Russia-linked economies

- Long-term fragmentation of global trade becomes a serious risk

Implications for India and Emerging Economies

Countries such as India face a delicate balancing act. Russian oil offers cost advantages and energy security, while U.S. tariff threats create risks for exports and trade relationships.

This environment may push emerging economies to diversify energy imports, strengthen diplomatic engagement, and re-evaluate long-term trade dependencies.

Big Picture: A New Era of Economic Pressure

The combination of U.S. strategic involvement in Venezuela and aggressive tariff proposals targeting Russian energy buyers reflects a broader shift in global policy.

Military force is no longer the only tool. Tariffs, sanctions, and trade barriers have become central instruments of power. As a result, global markets must now treat geopolitical risk as a permanent factor in valuation and strategy.

Conclusion

The developments surrounding Venezuela and the proposed Russia-related tariffs mark a turning point in global trade and energy dynamics.

This is not only about oil or politics. It is about control over supply chains, economic influence, and future market leadership. As these policies evolve, global markets will remain sensitive to every policy draft, announcement, and geopolitical move.