Today’s Market Wrap: Indian Markets Consolidate Near Record Highs Amid Mixed Global Cues

Indian Markets End Range-Bound Amid Cautious Sentiment

Indian equity markets concluded today’s session on a muted and cautious note, as investors chose to pause after the recent rally and evaluate both domestic and global cues. After touching higher levels in previous sessions, benchmarks witnessed profit booking and consolidation, indicating that the market is taking a breather rather than entering a corrective phase.

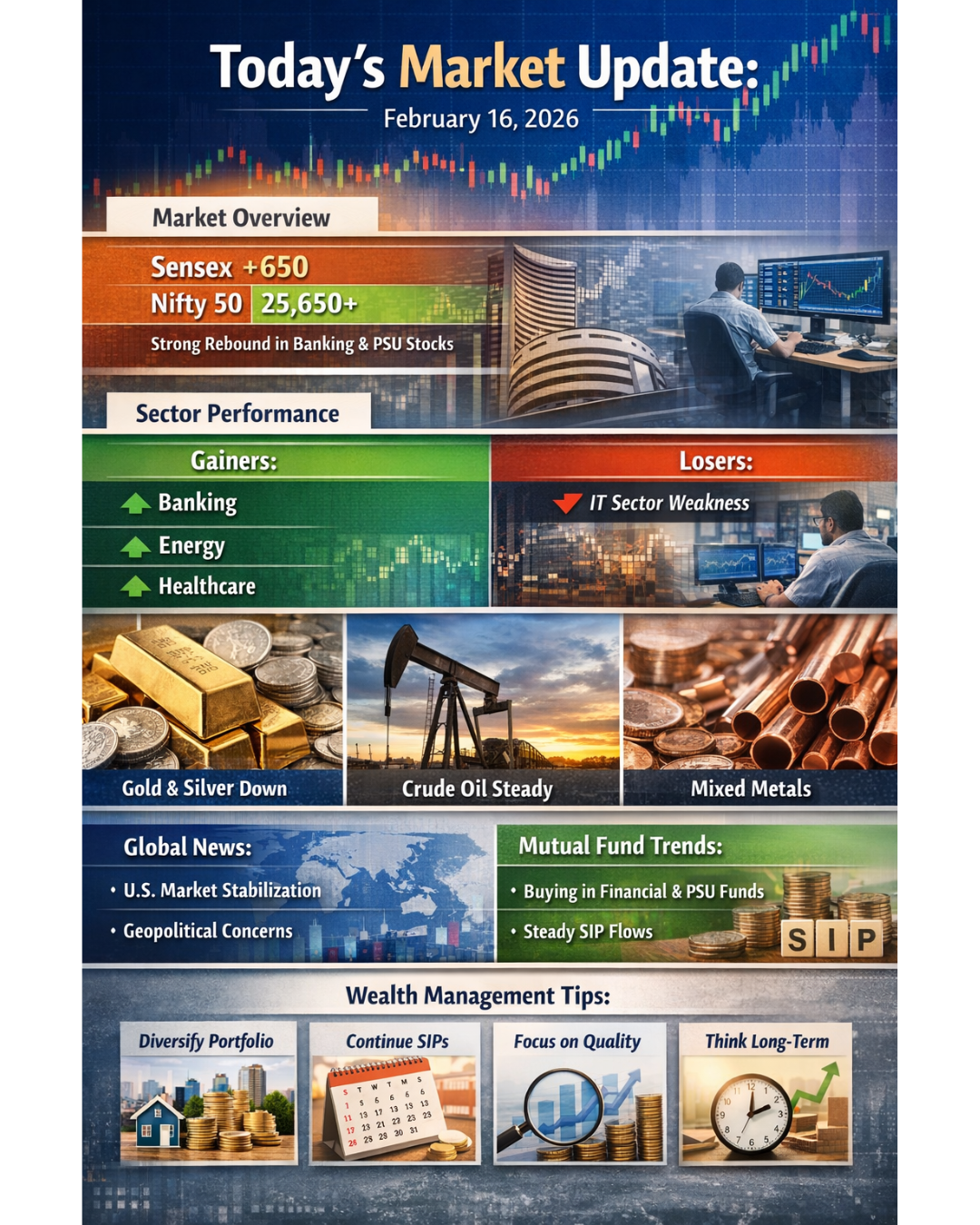

Market Numbers & Broad Trend

- Sensex ended the day marginally lower, reflecting selling pressure at higher valuations.

- Nifty 50 traded close to the crucial 26,000 psychological level, highlighting indecision among market participants.

- Bank Nifty remained mixed, as gains in select private banks were offset by weakness in others.

- Mid-cap and Small-cap indices underperformed the benchmarks, as investors turned cautious and booked profits in high-beta stocks.

- Overall, the market displayed a range-bound structure, with limited upside and downside movement.

Sector-wise Performance

Sector performance today clearly indicated rotation rather than broad-based selling:

- Auto and Metal stocks faced selling pressure due to valuation concerns and global demand uncertainty.

- IT stocks showed relative resilience, supported by the weakness in the Indian rupee, which improves export realizations.

- FMCG stocks remained stable, as investors preferred defensives amid uncertainty.

- Financials witnessed stock-specific action, with selective buying seen in quality names.

Key Domestic Market Developments

- Foreign Portfolio Investors (FPIs) continued to remain cautious, and intermittent selling weighed on overall sentiment.

- The Indian rupee weakened further against the US dollar, reflecting global dollar strength, persistent foreign outflows, and external macro pressures.

- Investors remained selective as they tracked developments related to global interest rates, inflation trends, and currency movements.

- Despite short-term volatility, domestic institutional participation provided some support to the market.

Global Market & Macro Cues

Global markets offered mixed signals, keeping Indian investors cautious:

- US and global markets remained sensitive to bond yield movements and central bank commentary.

- Crude oil prices stayed volatile, adding to inflation-related concerns.

- Currency fluctuations and global risk sentiment continued to influence capital flows into emerging markets like India.

Mutual Fund & Wealth Management Updates

- SIP inflows remained strong, indicating that retail investors continue to stay committed to long-term investing despite short-term market fluctuations.

- Increased volatility has led to higher interest in hybrid funds, balanced advantage funds, and large-cap oriented schemes, as investors seek stability along with growth.

- Fund managers continue to stress the importance of asset allocation, diversification, and disciplined investing instead of trying to time the market.

- Long-term investors are being advised to stay invested and use market dips as an opportunity through SIPs.

What Stood Out Today

- Consolidation after a strong rally

- Profit booking in mid and small-cap stocks

- Sector rotation rather than panic selling

- Continued support from domestic investors

- Elevated volatility indicating cautious sentiment

Market Outlook

- The near-term outlook for the market remains cautiously positive with volatility.

- The 26,000 level on Nifty will continue to act as a key support and sentiment indicator.

- Global cues, FPI activity, currency movement, and bond yields will be closely watched in the coming sessions.

- Stock-specific action is expected to dominate, especially in financials, IT, and defensive sectors.

- From a wealth management perspective, current market conditions reinforce the importance of long-term investing, SIPs, and disciplined financial planning.

Blissmoney Perspective

Markets may pause, fluctuate, or consolidate—but disciplined investing continues to create long-term wealth.