Market Wrap-Up Today: Indian Markets Close Lower Amid Volatility, Long-Term Outlook Remains Strong

Indian Equity Market Overview

The Indian equity markets ended today’s session on a weak note, extending consolidation seen over the past few sessions. Benchmark indices slipped as investors remained cautious amid year-end low volumes, persistent foreign fund outflows, and lack of fresh domestic triggers.

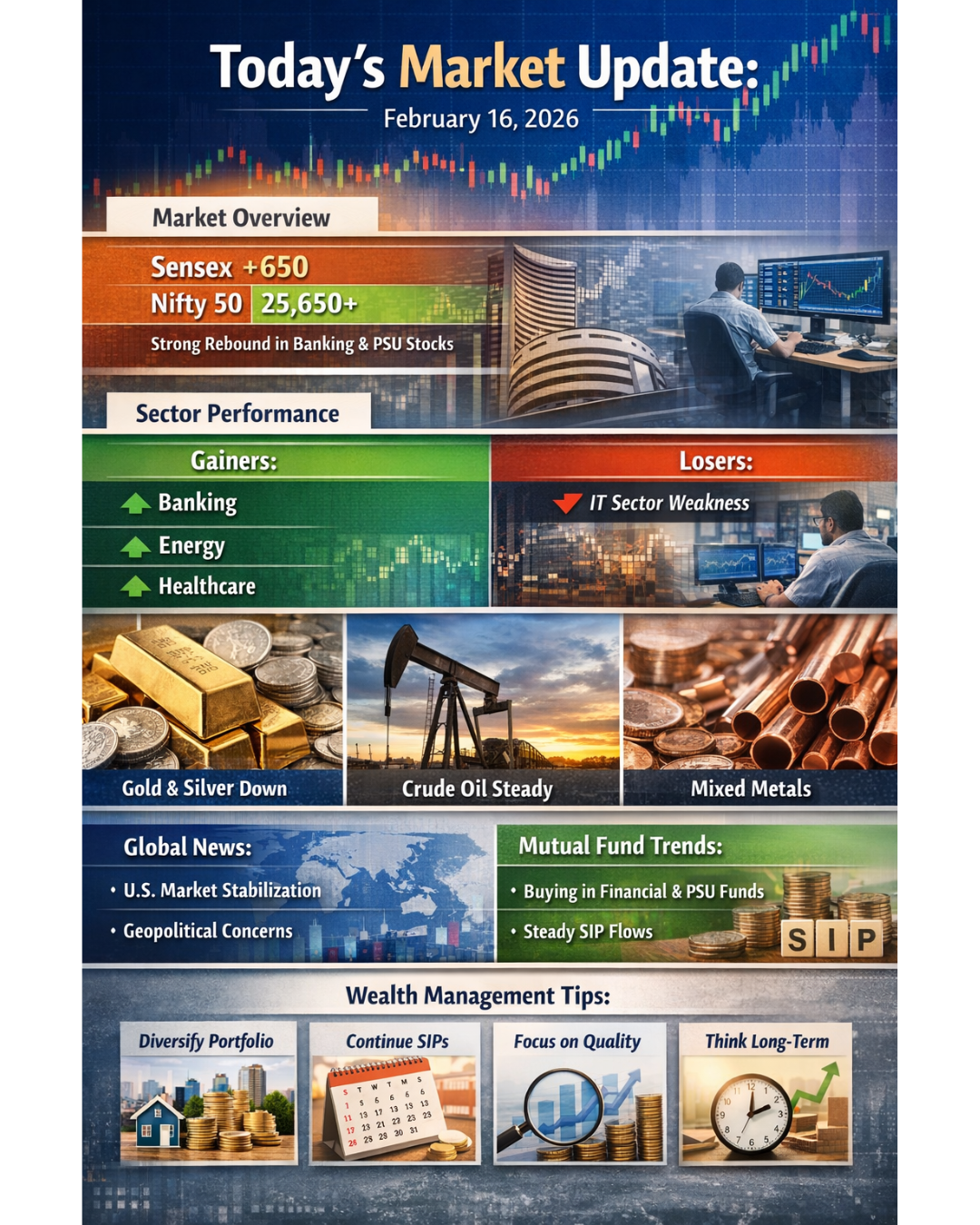

Key Index Closing Levels

- BSE Sensex: ~84,695 (Down ~346 points or ~0.4%)

- NSE Nifty 50: ~25,942 (Down ~100 points or ~0.38%)

- Bank Nifty: Marginally negative, underperformed broader markets

- Mid-cap & Small-cap indices: Closed lower, indicating broader market weakness

- Despite a stable opening, selling pressure intensified in the second half of the session, pushing indices into the red by the close.

Reasons for Today’s Market Fall (Detailed Analysis)

Year-End Profit Booking

- Many institutional and high-net-worth investors booked profits ahead of year-end portfolio rebalancing, leading to selling pressure across sectors.

Low Trading Volumes

- Holiday season participation remained thin, making markets more vulnerable to sharp moves on limited trades.

Foreign Institutional Investor (FII) Selling

- FIIs continued to remain cautious on Indian equities, preferring safer global assets amid global uncertainties and currency volatility.

Lack of Fresh Domestic Triggers

- No major policy announcements, earnings updates, or macroeconomic data supported bullish momentum today.

Global Caution

- Mixed global cues and geopolitical uncertainty kept risk appetite subdued.

Sector-Wise Performance

Top Losing Sectors

- IT: Weak global tech sentiment and cautious US outlook

- Realty: Profit booking after recent gains

- Auto: Margin concerns and muted demand outlook

- Pharma: Stock-specific selling pressure

Relatively Stable / Defensive Sectors

- Power

- FMCG

- Metal stocks showed selective strength due to firm commodity prices

Foreign Market Update

Global Equity Markets

- Asian Markets: Mixed performance; investors remained cautious due to geopolitical tensions and slowing global growth concerns.

- US Markets: Futures traded marginally lower as investors stayed defensive ahead of macro data and interest rate clarity.

- European Markets: Mostly flat to negative, tracking weak global sentiment.

Overall, global markets are in a consolidation phase after a strong rally earlier in the year.

Commodity Market Update

Gold

- International gold prices remained elevated but witnessed mild profit booking.

- Strong demand continues due to geopolitical risks, central bank buying, and expectations of softer interest rates.

- India price: Approximately ₹1,40,000 per 10 grams (24-carat)

Silver

- Highly volatile session.

- After touching record highs recently, silver corrected due to profit booking.

- India price: Around ₹2,50,000 – ₹2,58,000 per kg

Crude Oil

Crude prices traded firm due to:

- Stable demand outlook

- Supply discipline by major producers

- However, concerns over global growth limited upside momentum.

Other Commodities

- Copper: Remained strong on supply tightness and infrastructure demand.

- Industrial metals: Continued to benefit from long-term energy transition and EV-related demand.

Mutual Fund Industry Update

SIP Trend

Systematic Investment Plan inflows remained strong throughout the year, reflecting investor confidence and growing financial awareness.

Asset Allocation Shift

Investors are gradually moving towards:

- Hybrid funds

- Multi-asset allocation funds

- Passive funds and ETFs

Gold and Silver ETFs

Continued to attract inflows as investors seek portfolio hedging amid volatility.

Investor Behaviour

Long-term investors are maintaining SIP discipline despite short-term market corrections, which is a healthy sign for equity markets.

Wealth Management & Financial Planning Updates

Wealth managers are advising balanced portfolio strategies with a mix of equity, debt, and commodities.

Increased focus on:

- Capital protection

- Asset diversification

- Goal-based investing

High-net-worth investors are showing interest in alternative assets and global diversification.

Outlook Investors

For long-term investors, short-term market fluctuations like today’s correction should be viewed as normal and healthy phases of the market cycle. Temporary volatility driven by profit booking, global cues, or foreign fund flows does not change the underlying strength of the Indian economy.

India’s long-term fundamentals remain strong, supported by:

- Consistent economic growth

- Rising domestic consumption

- Expanding formal economy

- Strong corporate earnings potential over time

History shows that investors who remain patient, focused on goals, and aligned with long-term financial planning tend to benefit the most from equity markets over time.