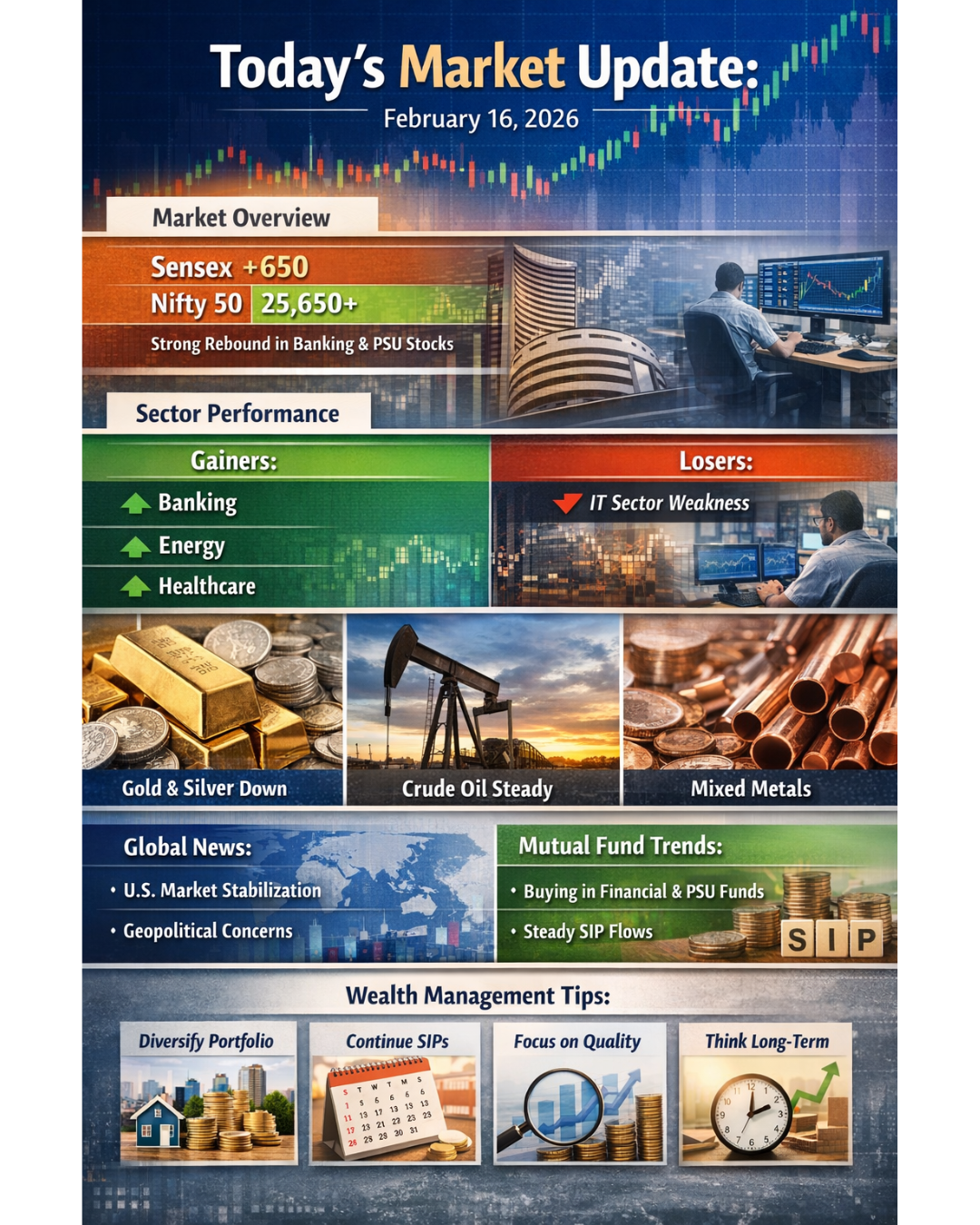

Weekly Market Report: Sensex & Nifty Movement, FII-DII Flows and Global Market Trends – Feb 2026

1. Indian Market Overview

Benchmark Performance

- BSE Sensex: Closed around 82,793

- NSE Nifty 50: Closed around 25,565–25,571

Indian equity markets ended the week on a positive note despite mid-week volatility. After initial weakness triggered by global uncertainties and sectoral pressure, the markets witnessed a strong recovery toward the end of the week led by large-cap stocks.

Weekly Movement

- Markets experienced mid-week selling pressure.

- Friday saw a strong rebound supported by financials, power, and select heavyweights.

Overall, indices closed marginally positive week-on-week.

The broader trend reflects consolidation with selective buying rather than a broad-based rally.

2. Global Market Performance

- United States - US markets ended the week higher after positive sentiment emerged following major legal and trade-related developments. Investor confidence improved as uncertainty around tariff measures reduced.

- Global Capital Flow Trends - There has been noticeable capital rotation globally, with investors reallocating funds from certain developed markets into select emerging and international markets.

Overall, global markets remained cautious but stable.

3.FII and DII Activity (Institutional Flows)

Weekly Institutional Trend

- Foreign Institutional Investors (FII): Net sellers during the week

- Domestic Institutional Investors (DII): Net buyers throughout the week

On the latest trading day of the week:

- FII sold approximately ₹935 crore

- DII bought approximately ₹2,637 crore

Weekly Pattern

While complete consolidated weekly numbers are still being compiled, the broader trend clearly shows:

- Continuous FII selling pressure

- Strong DII support cushioning the fall

- Domestic liquidity continues to play a stabilizing role in Indian markets.

4. Sector Performance

Outperforming Sectors

- Financials

- Power and Infrastructure

- Select large-cap energy stocks

Underperforming Sector

- Information Technology (IT) - IT stocks faced pressure due to continued foreign selling and concerns around global demand outlook. This sector contributed significantly to intra-week volatility.

- Mid-cap and small-cap segments showed mixed performance with stock-specific movements.

5. Important Market Developments This Week

- Global trade policy developments influenced global sentiment.

- Continued FII outflows weighed on IT and export-oriented stocks.

- Strong DII participation prevented deeper corrections.

- Sectoral rotation was clearly visible, with investors moving toward defensives and domestic cyclicals.

6. Mutual Fund Impact

- Ongoing SIP inflows continue to provide stability to markets.

- Large-cap and diversified equity funds remained relatively stable compared to sector-specific funds.

- IT-focused funds saw short-term pressure.

- Hybrid and balanced funds performed steadily due to diversified allocation.

- The resilience of domestic inflows highlights the maturity of retail participation in Indian markets.

7. Wealth Management Perspective

Market Outcome This Week

- Indices closed positive despite volatility.

- Domestic liquidity remains strong.

- Foreign selling continues but is being absorbed.

This indicates structural strength in Indian markets supported by long-term domestic capital.

8. Outlook for Next Week

Key factors to monitor:

- Continuation or reversal of FII flows

- Global economic data and geopolitical developments

- Sector rotation trends

- Domestic macro indicators and liquidity conditions

Markets may remain range-bound with stock-specific action. Volatility could continue but major breakdown signals are not visible currently.

9. Advice for Investors (Wealth Management Guidance)

For Long-Term Investors (3–5 Years Horizon)

- Continue SIP investments in diversified equity mutual funds.

- Focus on quality large-cap and financial sector exposure.

- Do not react emotionally to short-term volatility.

- Maintain asset allocation discipline.

For Medium-Term Investors

- Be selective in IT exposure.

- Consider sectors showing domestic demand strength.

- Maintain stop-loss discipline if trading actively.

Risk Management Strategy

- Maintain 10–20% allocation in debt or hybrid funds for stability.

- Avoid overexposure to a single sector.

- Rebalance portfolio periodically.

- Focus on goal-based investing rather than market timing.

Conclusion

The week reflected resilience in Indian markets despite foreign selling and global uncertainty. Domestic institutional strength continues to support market structure. While volatility may persist, long-term wealth creation opportunities remain intact for disciplined investors.