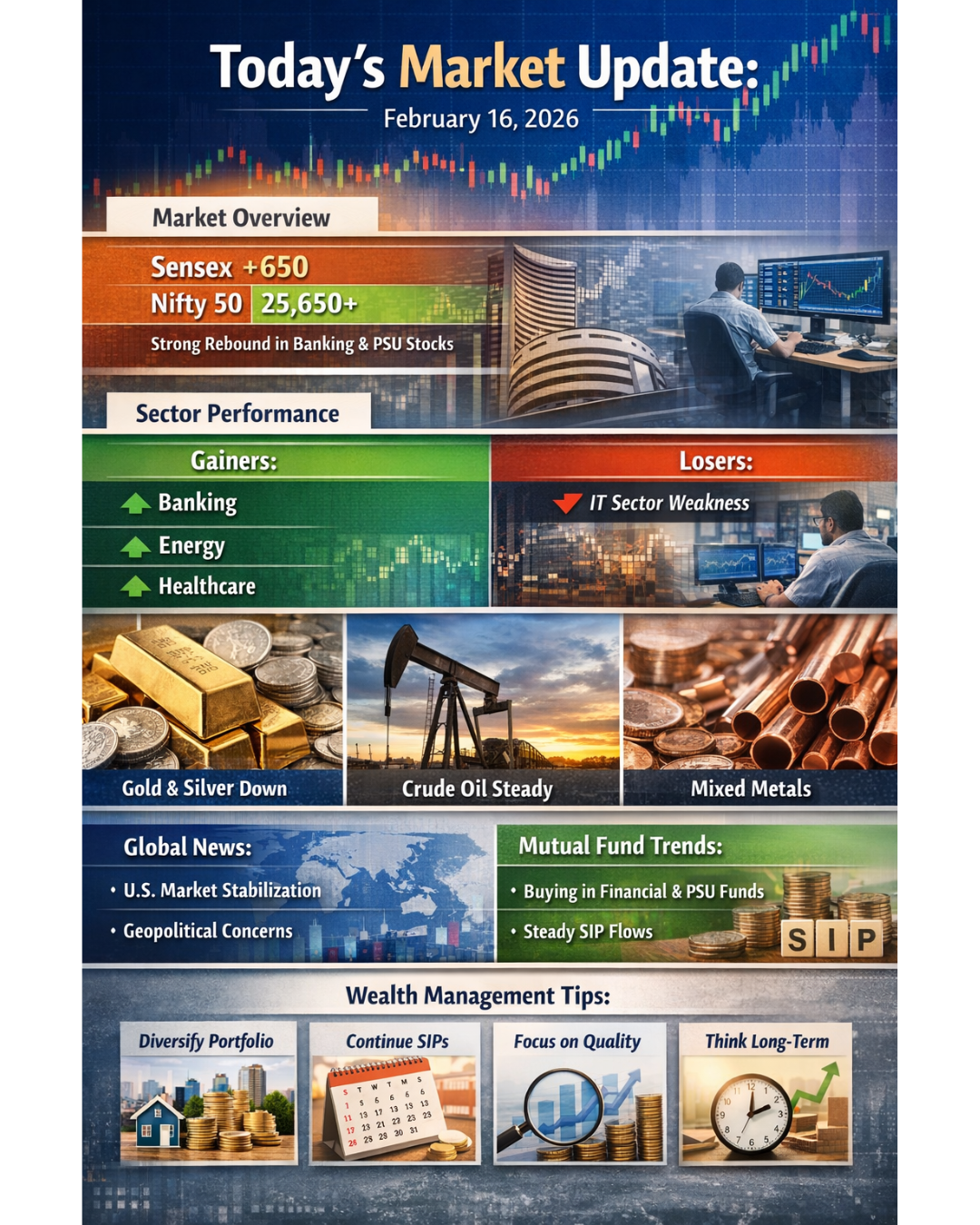

Today’s Market Update: Strong Closing Rally, Sector Performance, Commodities & Global Impact – 16 February 2026

Indian equity markets witnessed a strong recovery today after opening on a cautious note. Despite early weakness, benchmark indices rebounded sharply in the second half of the session, supported by buying in banking, PSU, and energy stocks.

Market Opening and Closing Summary

The market opened under pressure following weak global cues and continued concerns in the IT sector.

- Nifty 50 opened below the 25,450 mark.

- Sensex opened over 100 points lower.

However, strong buying interest emerged during the day, leading to a sharp turnaround.

Closing Highlights:

- Sensex closed approximately 650 points higher.

- Nifty 50 closed above 25,650.

The rally helped the market end its recent losing streak and restored short-term investor confidence.

Sector Performance

Strong Performing Sectors

- Banking and Financials: Banking stocks led the recovery. Private and PSU banks witnessed strong buying, indicating value accumulation at lower levels.

- Energy and PSU Stocks: Power and infrastructure-related companies showed strength, contributing significantly to the index recovery.

- Healthcare and Pharma: Selective buying was seen in defensive healthcare stocks.

Underperforming Sector

- Information Technology (IT): The IT sector remains under pressure due to global concerns around technology spending, AI-related disruptions, and weak sentiment from overseas markets. While today saw some stabilization, the sector is still facing volatility.

Commodities Market Update

- Gold - Gold prices corrected by around ₹1,000 per 10 grams due to profit booking after recent highs. The correction is seen as healthy consolidation rather than a structural weakness.

- Silver - Silver witnessed a sharper decline, falling by more than ₹8,000 per kg. The fall was largely driven by global price correction and reduced speculative activity.

- Crude Oil - Crude oil prices remained relatively stable with minor fluctuations. Global supply-demand balance and geopolitical developments continue to influence oil prices.

- Base Metals - Industrial metals such as copper and aluminum showed mixed trends, reflecting uncertainty in global demand outlook and manufacturing data from major economies.

Foreign Market News and Global Impact

- Global markets provided mixed cues today.

- US markets showed signs of stabilization after recent volatility.

- Concerns around global tech earnings and AI-led disruptions continue to influence investor sentiment.

- Geopolitical developments and inflation data from major economies are creating short-term uncertainty.

- Foreign Institutional Investors (FIIs) have remained cautious in recent sessions, leading to volatility in Indian markets. However, domestic institutional buying supported today’s recovery.

Mutual Fund Updates

- Equity Mutual Funds - Sectoral funds with higher allocation to banking and PSU stocks performed better compared to IT-focused funds. Investors are showing interest in diversified equity funds rather than concentrated sector exposure.

- Debt Funds - With market volatility rising, debt mutual funds are seeing renewed interest as investors look for stability and capital preservation.

- SIP Trends - Systematic Investment Plans continue to remain strong, reflecting long-term investor confidence despite short-term market fluctuations.

Wealth Management Strategy for Investors

1. Avoid Emotional Decisions - Short-term volatility should not lead to panic selling. Markets often recover sharply after corrections.

2. Review Asset Allocation - Ensure your portfolio is diversified across:

- Equity

- Debt

- Gold

- Liquid funds

Proper allocation reduces risk during sector-specific downturns.

3. Focus on Quality - Invest in fundamentally strong companies and well-managed mutual funds with consistent track records.

4. Continue SIPs - SIPs help average purchase cost during volatile periods and are effective for long-term wealth creation.

5. Maintain Long-Term Perspective - Market corrections are part of economic cycles. Long-term disciplined investing remains the key to wealth accumulation.

Overall Market Outlook

- Today’s strong recovery suggests that underlying domestic strength remains intact despite global uncertainties. While the IT sector continues to face short-term pressure, banking and PSU stocks are providing support to the broader market.

- Commodity correction, stable oil prices, and steady domestic inflows indicate that the market may consolidate before its next directional move.

- For investors, this phase calls for discipline, diversification, and strategic wealth management rather than reactive decision-making.